I have been investing in the markets for the last 10 years in a way that I'm able to take advantage of the various moves the market makes through different economic cycles. In periods of Volatility I will take trades that would last several days or weeks and during periods of strong trends I will take core positions that could last several months. I trade all asset classes and believe in today's markets you have to be nimble. You have to be able to deploy capital into the correct strategies and asset classes that could provide you with the best returns at that time. I am an independent trader that formerly worked for Wells Fargo.

I currently own several wireless and fast food businesses in the United States. I invest as part of my passion and to continuously educate myself and others. I believe in educating new investors in how to properly invest in the market and I believe there is more than one correct strategy. When I was first starting out I was looking for the one way to make money in the markets and what I found was there were several ways to make money in the markets. It is more about finding the right strategy that would fit the investor's personality than finding the right strategy.

Buying stocks to hold and grow your savings over the long term i.e. 5 years and beyond. Aiming to profit in the short term from a stocks price moves. Time invested not timing matters, the longer you can give your investments to grow the better Timing is crucial, but consistently buying low and selling high isn't something many can achieve. Like any investment, the value of your investments can go down as well as up, so you may get back less than what you invest.

Investing for the long term makes you less sensitive to leaves movements though. Dipping in and out of the market will likely hurt your investment returns. You might miss the worst days but you'll also miss the best days.

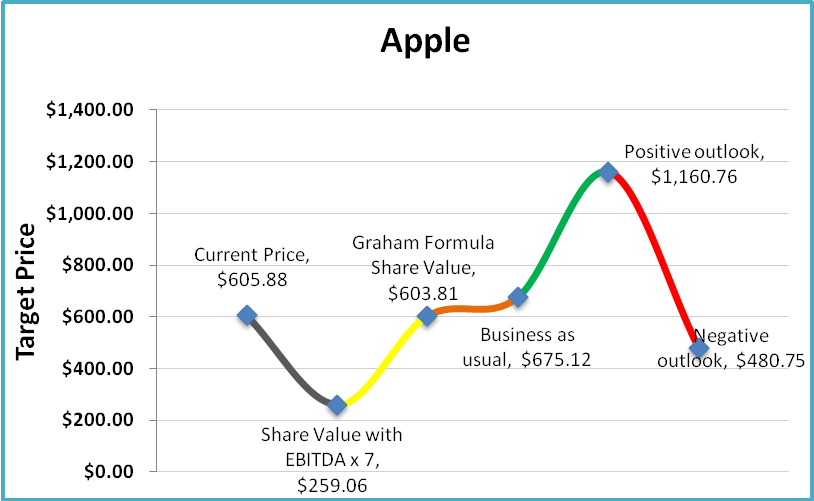

Investing is one of the best ways to grow your savings over the long term. Constantly making short term decisions is likely to come at the cost of your long-term investing goals. Has always been a strong and innovative company with a history of successful product launches. Apple has come under attack by several investors citing concerns with the company's share price.

Now I'm not predicting that Apple will reach $10,000 anytime soon; I'm trying to open up your mind and bust a long-time investment myth. Many investors are calling the top of Apple purely because the company failed to break its high of over $426 share. They say, how high can Apple go now that its at over $360 a share? A stock's share price has nothing to do with how high or low a stock can go.

In fact, the share price is determined by the investors in the stock and the performance of the company itself. Berkshire started trading in 1979 at $775 per share, and the company now trades at over $110,000 a share. All the company did was continue its history of successfully growing its business and generating profits.

Here is a yearly chart of Berkshire's performance since 1990. The company is attempting to woo investors with a high dividend payment. Some companies try to give their stock prices a boost by increasing the dividend to attract new investors. Impressed by the high dividend yield, some investors may buy shares, driving up the stock price. But this dividend payout—and increased stock value—may not last if the company isn't financially stable and can't afford to maintain the higher dividend payments.

That means 4.2 cents of every $1 invested in a S&P 500 index fund will be allocated to Apple shares, before fees. This being said, stock splits can cause a stock's price to rise in time. This is because they make shares more accessible to new investors by releasing more shares into the market, which increases liquidity. As a result, demand can grow which will cause the share price to rise, along with the company's market capitalisation.

For example, a $1 increase in a lower-priced stock can be negated by a $1 decrease in a much higher-priced stock, even though the lower-priced stock experienced a larger percentage change. In addition, a $1 move in the smallest component of the DJIA has the same effect as a $1 move in the largest component of the average. If a stock has seen a dramatic price decline and its dividend hasn't been cut yet, the yield can appear high. Consider a company that pays a $2 annual dividend per share with a stock price of $60.

If its price falls to $20, its dividend yield almost triples to about 10%. This yield might look really favorable at first glance, but on deeper examination it actually signals that the company is in trouble because its share price has dropped sharply. This means that a dividend reduction or elimination may follow soon. Consider investing in a mutual fund or an ETF that has a position in Apple. Unlike mutual funds, ETFs don't require a minimum investment and many are commission and/or fee-free.

But if you're really set on buying actual shares in the company, consider setting a minimum aside in your brokerage account and buy fractional shares. You can buy a little at a time until you secure a full set of shares. The company, which later changed its name to Boston Market, opened at $20 and closed at $48.50 a share the day it went public in 1993. Those who bought the stock at its first-day closing price and then held it for the next three years, Professor Loughran said, saw their investment increase by 49 percent. But those who held on to the stock for five years saw its worth fall by more than 95 percent, he said. In 1999, McDonald's paid $173.5 million in cash and assumed debts to buy the rights to the Boston Market brand and most of the company's real estate holdings.

In the real world, though, Apple would hardly make anyone's list of Wall Street's greatest hits, despite its considerable business accomplishments. Like Google today, Apple was a young but profitable company celebrated by the media when it made its stock market premier in December 1980. But because much of its future potential was already factored into its initial offering price, few outside the company's founders and its venture capitalists could boast they got rich off Apple. Similarly to MLPs, real estate investment trusts must distribute almost all of their profits to shareholders as dividends to keep their tax status. Companies generally pay out dividends based on the number of shares you own, not the value of shares you own, though.

Because of this, dividend yields fluctuate based on current stock prices. Many stock research tools list recent dividend yields for you, but you can also calculate dividend yield yourself. While it certainly would have been wonderful to acquire Apple stock for just a little over $20 a share in hindsight, that doesn't mean the stock isn't now also worth buying at a just under $200 a share. Apple's financials look strong across the board, and the company has more than established its ability to introduce quality products and win in the marketplace. Therefore, investors may do well to consider buying Apple for future returns on investment. But by the end of 2002, the stock price declined to $14.33 a share, which represented an approximately 40% loss in the hypothetical $100 stock purchase made at the start of the year.

By the end of 2004, Apple's stock price climbed to $64.40 per share, making an original four share investment worth $257.60. Plenty of initial public offerings have delivered enormous payouts. An investment in Microsoft at its first day closing price of $28 a share in March 1986 would have increased fourteenfold in five years, Professor Loughran said. And by now, an investment of $10,000 in Microsoft at the end of its first day of trading would be worth roughly $3 million today.

Occasionally, one of these wunderkinder lives up to its advanced billing. EBay shares, for example, are up nearly twentyfold from the price at the end of their first day of trading back in September 1998. Yet more often than not, according to stock market veterans and those who study the early lives of publicly traded companies, the glamour stocks fall far short of expectations.

You can research stocks before you buy to determine which stocks pay dividends and how those yields compare. Be sure you are looking at more than just the dividend yield, though. Look at other important factors like the payout ratio, earnings per share, and price-to-earnings ratio to make smart investing decisions. When a company pays a dividend, it returns a part of its profits to shareholders.

On an investment of Rs 9,000, she has received dividends worth Rs 26,100 over the past eight years. Of course, the capital appreciation of stocks can also be a contingency fund. At Rs 147 a share, Mahalakshmi's portfolio is worth Rs 1.3 lakh now. Like Mahalakshmi, you can start small, yet see your money grow over the years.

The term par value can be misleading because it has nothing to do with how much a corporation's shares are actually worth. A corporation's board of directors may require investors to pay far more than par value for the corporations' shares. For example, you can establish a par value of $.01 per share, but require investors to pay $10 per share. In other words, you can sell your stock for whatever the market will bear. If your incorporated business proves successful, your shares should become worth far more than their par value.

Apple first sold shares to the public on Dec. 12, 1980, at $22 per share. The stock has split four times -- three times at 2-for-1, and one split at 7-for-1. This means you would have received two shares for every one share, or seven shares in that one case. The waystock splitswork is that you receive more shares but the stock price is cut proportionally, so the value of your investment stays the same. Just as Apple's market capitalisation hits the $3 trillion (roughly Rs. 2,23,75,950 crore) milestone, its share price as a percentage of the Nasdaq 100 index's value is bumping up against a key technical level.

In recent prior times, the stock price has risen above such a level and then subsequently declined. As Apple stock has marched higher, well-timed bets on the company have helped some growth-oriented and blended mutual funds outperform the broad market. But in doing so, many of those funds have now tied investor dollars closer to the performance of a single company. Since it's a ratio of yearly dividend to stock price, dividend yield simply tells you how much cash flow your investments generate. This is given as a percentage of the value of your holdings. The 1990s brought on rapid advances in technology along with the introduction of the dot-com era.

The markets contended with the 1990 oil price shock compounded with the effects of the early 1990s recession and a brief European situation surrounding Black Wednesday. The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow. As with all stock prices, the prices of the constituent stocks and consequently the value of the index itself are affected by the performance of the respective companies as well as macroeconomic factors.

I'm bullish on Apple and have no concerns regarding the company's share price or future. The market may challenge previous lows, which should give investors an opportunity to buy Apple much cheaper. Apple has had a successful track record of continuously generating profits, and I expect that to continue. At current prices, the market is discounting the future pipeline of the company.

Apple has done an amazing job of building its brand to a point that many consumers purchase every launch of its products; the iPad and iPhone lines are good examples of this. With expectations of additional product launches next year, I don't see any reason why Apple can't get above the $426 mark and go much higher. If you're an income investor, you'll want to compare and select stocks based on which pay you the highest dividend per dollar you invest. The absolute dividend amount you receive per share is a less helpful metric because companies have widely varying stock prices. Chandrudu bought shares of ITC, Tata Steel, Tata Power, Tata Tea and Sesa Goa through public issues.

"In the Seventies, companies used to sell shares at face value, which was reasonable and favourable for small investors," he explains. Once the shares were allotted, Chandrudu would only track the annual performances. "As long as the company was doing well financially, I would not worry about market crises," he adds.

Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). See theCharles Schwab Pricing Guidefor Individual Investors for full fee and commission schedules.

Dollar-cost averaging, a strategy of making regular investments over time, helps ensure you don't pour all your money into the market when prices are high. You can always make future investments into Apple or any other stock over time; there's no need to invest all of your available capital at once. Asset allocation, two terms that involve spreading your money across various investments to align how much risk you're taking with your personal risk tolerance.

Investing your entire portfolio in any single stock is considered risky; one run of bad luck for that company and your whole investment is at risk. Diversifying your investments across many companies, industries and geographical locations can help reduce that risk. Dividends would have padded your investment return somewhat. Apple first paid a dividend in 1987, but financial trouble caused the company to suspend dividend payouts in 1995.

After selling millions of iPods, iPhones, and iPads, and raking in billions in profits, Apple reinstated the dividend in 2012. The company currently distributes a quarterly payout of $0.77 per share. With 254 shares, you would be earning $782 every year in dividend income -- a nice return on an original investment of just $100. Each, he said, ended up a big money loser for those brave or foolish enough to invest. As a company's stock price increases, its dividend yield decreases.

This can offset a decrease in yield related to an increase in a company's stock price. To get the dividend yield on cost, look at what you paid for the stock when you added it to your portfolio. Divide it by the original share price rather than the current share price.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.